Rails of Opportunity

Mongolia's Crossroads Between Energy Boom and Geopolitical Dilemma

Xincheng Chao

March 14, 2023

Introduction

China, Russia, and Mongolia have confirmed the extension of the Outline of the Development Plan on Establishing the China-Mongolia-Russia Economic Corridor by five years, the three countries announced in a trilateral meeting in the Uzbek city of Samarkand.

In September 2022, at the sixth trilateral summit involving China, Mongolia, and Russia, the nations concurred on a five-year extension of the Guidelines for the China-Mongolia-Russia Economic Corridor. This decision dovetails with the objectives of the Belt and Road Initiative (BRI), aiming to broaden its infrastructure outreach globally. Notably, Mongolia and Russia, lying along one of the six main corridors of this expansive global initiative, emphasize the importance of the China-Mongolia cross-border railway project within their collaboration as part of the broader China-Mongolia-Russia Corridor (C-M-R Corridor).

Mongolia's unique geographic position as a landlocked nation flanked by two influential UN permanent members, China and Russia, underscores its strategic significance but also the dilemma it faces in connecting to outside markets. The extensive China-Mongolia border, spanning over 3,000 km with numerous land ports yet predominantly serviced by road, previously constrained the full potential of bilateral trade and cooperation. The limited infrastructure significantly restricted trade capacity and hindered further collaborative efforts.

To address these constraints and foster an export-oriented economy by promoting priority sectors, Mongolia's State Great Hural (Parliament) outlined a three-phase infrastructure development strategy in its "Vision 2050" National Strategy. The strategy's initial phase, covering 2020 to 2030, focuses on connecting key economic regions and sectors through infrastructure development, specifically targeting the construction of railways to link strategic mineral deposits with border crossings.

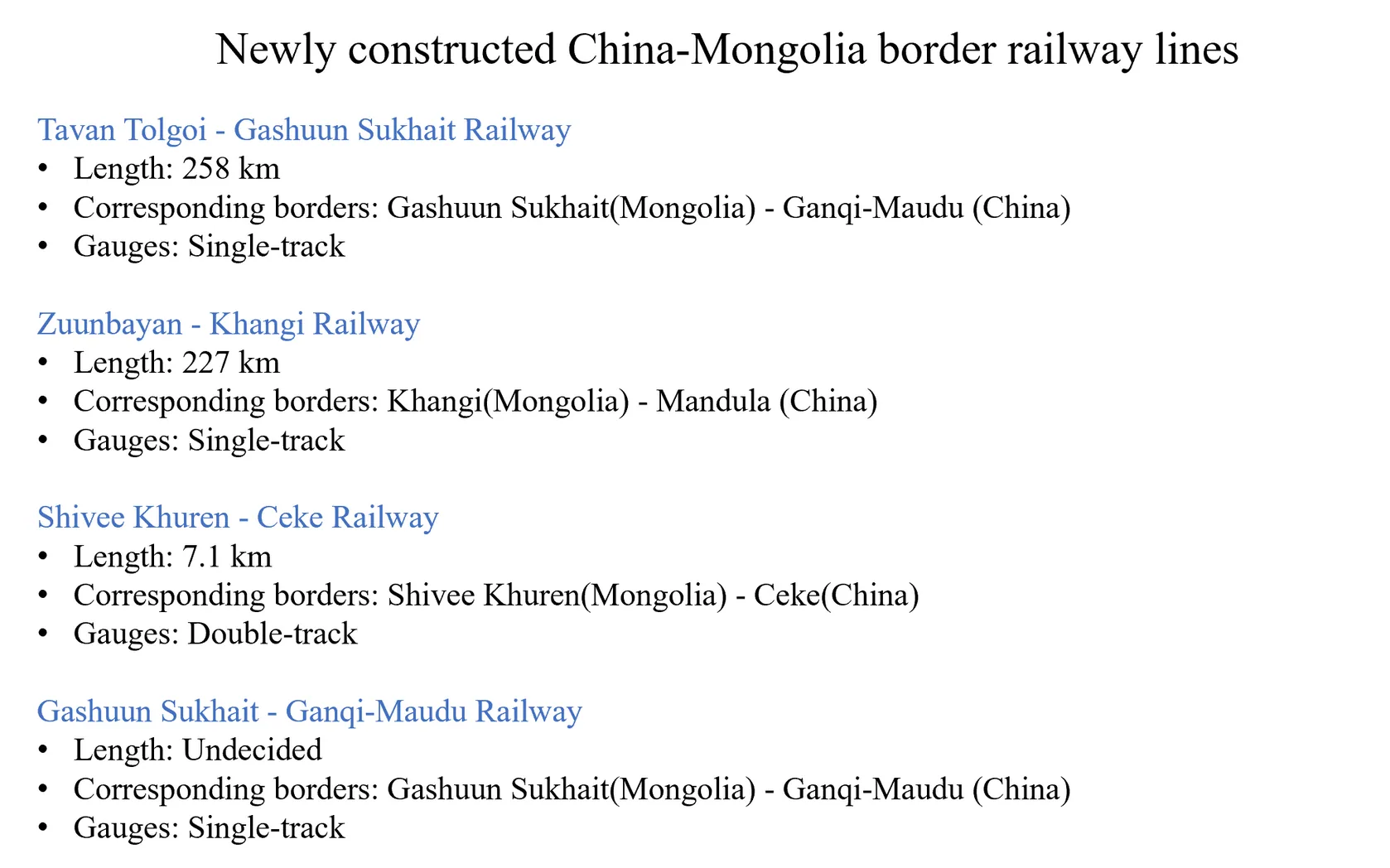

The "New Recovery Policy" approved by the State Great Hural in 2021, which aimed to help the national economy recover from the pandemic influence also emphasized the "Border Ports Recovery" as a crucial part of the recovery plan. These visions materialized with the completion of significant railway projects such as the Tavan Tolgoi - Gashuun Sukhait line in September 2022 and the Zuunbayan - Khangi line in November 2022. Furthermore, the construction of a new railway connecting the border cities of Shivee Khuren and Ceke is underway, and the construction of the Gashuun Sukhait- Ganqi- Maudu Railway is expected to start soon.

Data compiled by author

The mutual interests of China and Mongolia in developing these cross-border railway lines signal a promising direction for the C-M-R corridor, serving as a flagship project. Nevertheless, despite the evident economic and national development benefits under the BRI framework, potential challenges to the sustained success of these projects remain underreported by public media and governmental discourse. This storymap aims to delve into the motivations behind Mongolia's cross-border railway initiatives, highlight their contributions, and examine the challenges that could impact their long-term viability.

12/2021

The State Great Hural approved the “New Recovery Policy” where border ports recovery plays a crucial role in

11/2022

Zuunbayan-Khangi Railway becomes operational

01/2024

Mongolia and China railway company heads discussing the schedule of the Gashuun Sukhait - Ganqi- Maudu Railway with an expected starting date of April 30th

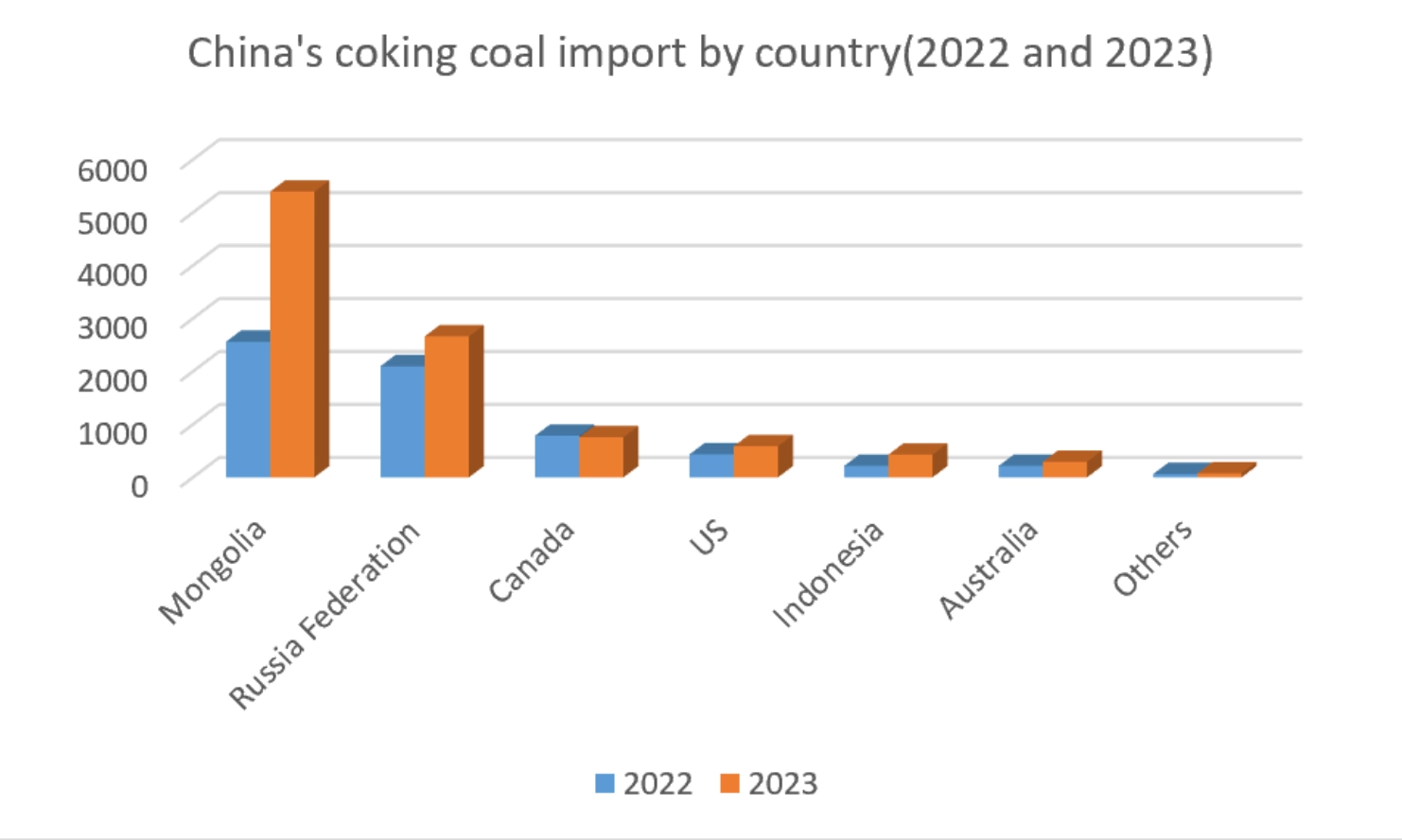

Expanding Dependency: China's Growing Demand for Energy from Mongolia

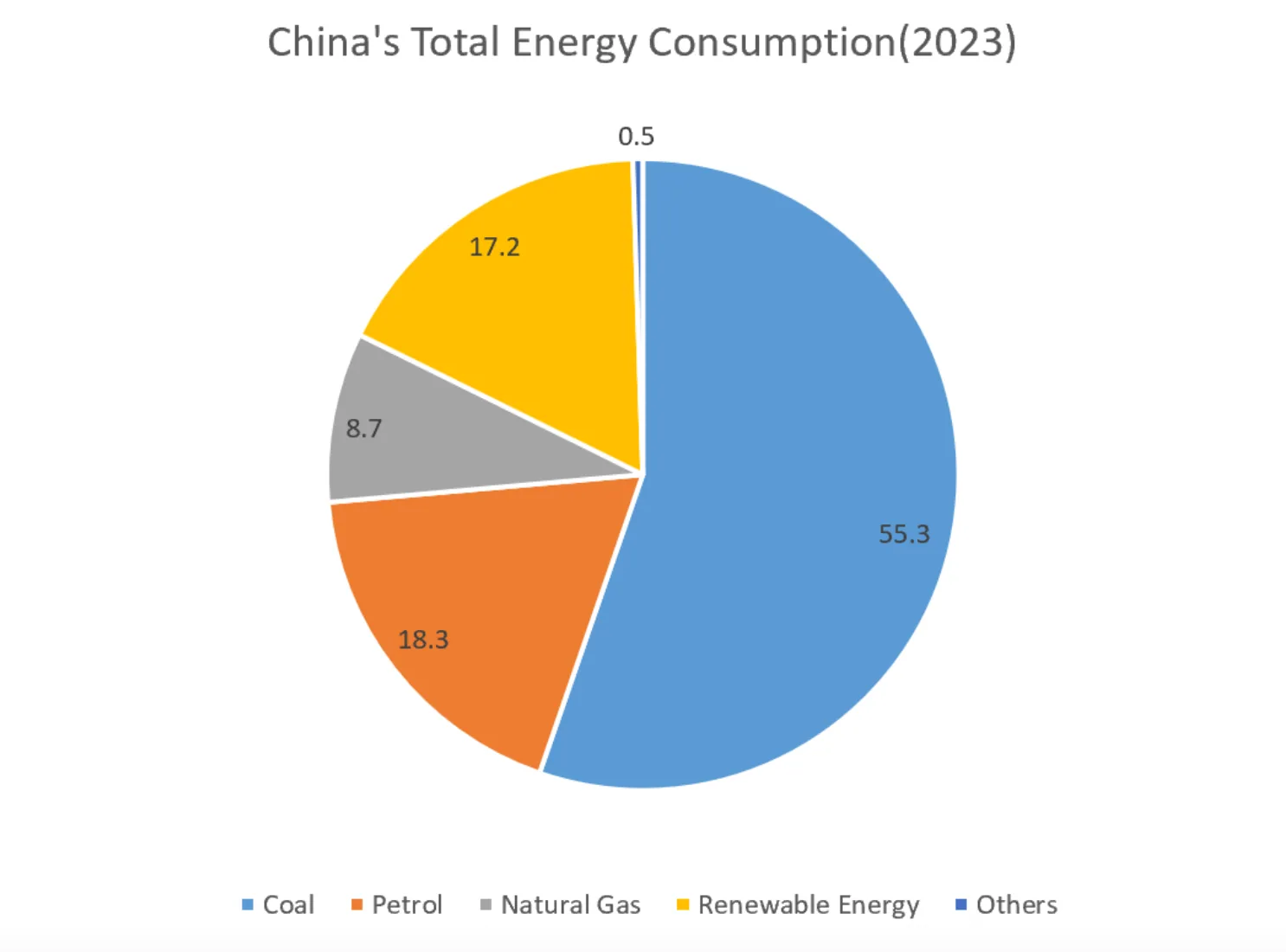

According to the Statistics from the National Bureau of the People’s Republic of China, “In 2023, the number of coal imported from other countries has reached 474 million tons, with a year-on-year growth of 61.8%, making 2023 the historically high year for coal imports.” China's escalating demand for energy, particularly coal, underscores the critical role Mongolia plays in its energy import strategy.

In 2023, the number of vehicles carrying coals that passed through the Chinese borders reached a record high. Ganqi Maodu border, the largest road border between China and Mongolia, witnessed coal imports of 365.12 million tons, with a year-on-year growth of 102.37% .

As China's largest trade partner and primary source of coal imports, Mongolia has become increasingly vital to China, especially in the context of China's "energy consumption bundle where coal is a dominant component. Notably, coking coal, essential for steelmaking and ironmaking, highlights the symbiotic trade relationship between the two nations. Despite China's significant domestic production of coking coal, its internal demand exceeds supply, necessitating imports to bridge the gap.

This dependency has been further accentuated by geopolitical tensions with Australia, previously China's main coking coal supplier , which led to a sharp decline in Australian coal imports and a pivot towards Mongolian coal due to a consumer boycott and subsequent import bans initiated by China.

Data Source: General Administration of Customs of the People's Republic of China

The reliance on Mongolian coal, however, is not without its challenges, primarily due to logistical constraints at the China-Mongolia border. With a limited number of functional border crossings and reliance on truck transportation due to inadequate railway infrastructure, the capacity to efficiently transport coal from Mongolia to China is severely hampered. This bottleneck has prompted Mongolia to invest in expanding its railway network, an initiative outlined in its 2020-2024 Action Plan aiming to enhance economic growth and export capabilities.

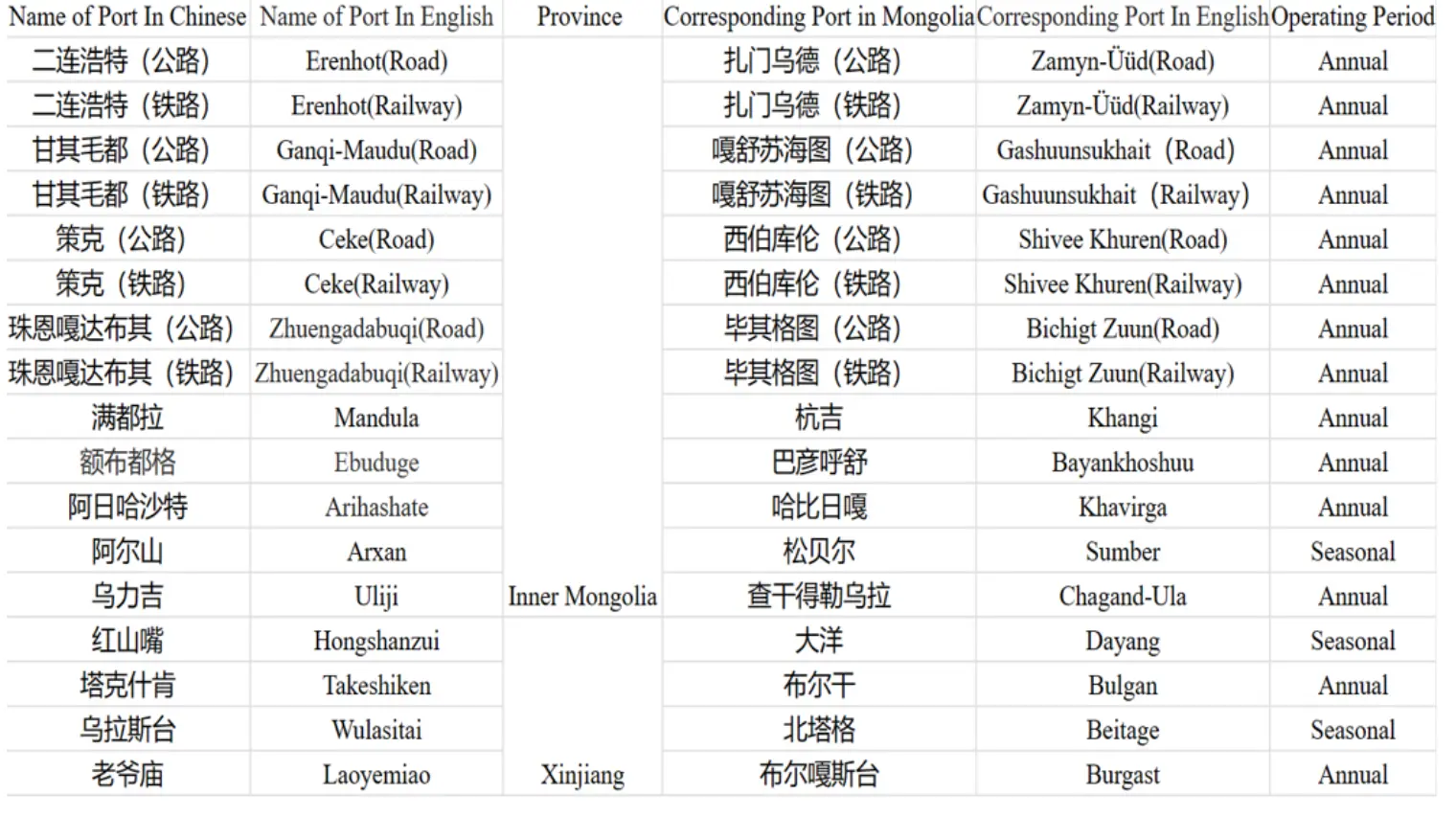

Border Bottlenecks: The Challenges of Overland Energy Trade Between China and Mongolia

As of 2023, China maintains 17 border crossings with Mongolia, serving as critical junctures for the export of Mongolian coking coal. The primary routes for this export are through the Erlian-Zamyn-Uud, Mandula-Khangy, Ganqi-Maodu, and Cake-Shivee Huren borders. Among these, Erenhot Port stands as the sole operational railway port, with the others not yet functional for railway transport despite their design for this purpose. Operational since 1956, this railway link connects Beijing, Ulaanbaatar, and Moscow. However, this single operational railway port is insufficient to cater to China's burgeoning energy import needs.

17 Border Crossings between China and Mongolia(Data Source: Ministry of Foreign Affairs of China, compiled by author)

Coal mines located at significant distances from the Erenhot-Zamyn Uud railway border force exporters to utilize road transport from the closest land borders, resulting in most exports being conducted via trucks through land crossings. The existing railway border has reached full capacity due to a limited number of railway lines and the rising demand from China, highlighting the inadequacy of land border facilities to manage the flow of all minerals and coal from Mongolia.

There is an urgent demand for more cross-border railway lines to mitigate transportation costs and ease the load on the current railway infrastructure. In response, Mongolia has put forth the Action Plan for 2020-2024, launched in August 2020, to revolutionize its transport sector. This plan's goal is to enhance and expand the road and transportation networks, driving economic growth and boosting exports, thereby strengthening Mongolia's ability to fulfill the growing Chinese demand for energy.

Strategic Expansion: The Drive Behind Mongolia's Cross-Border Railway Development

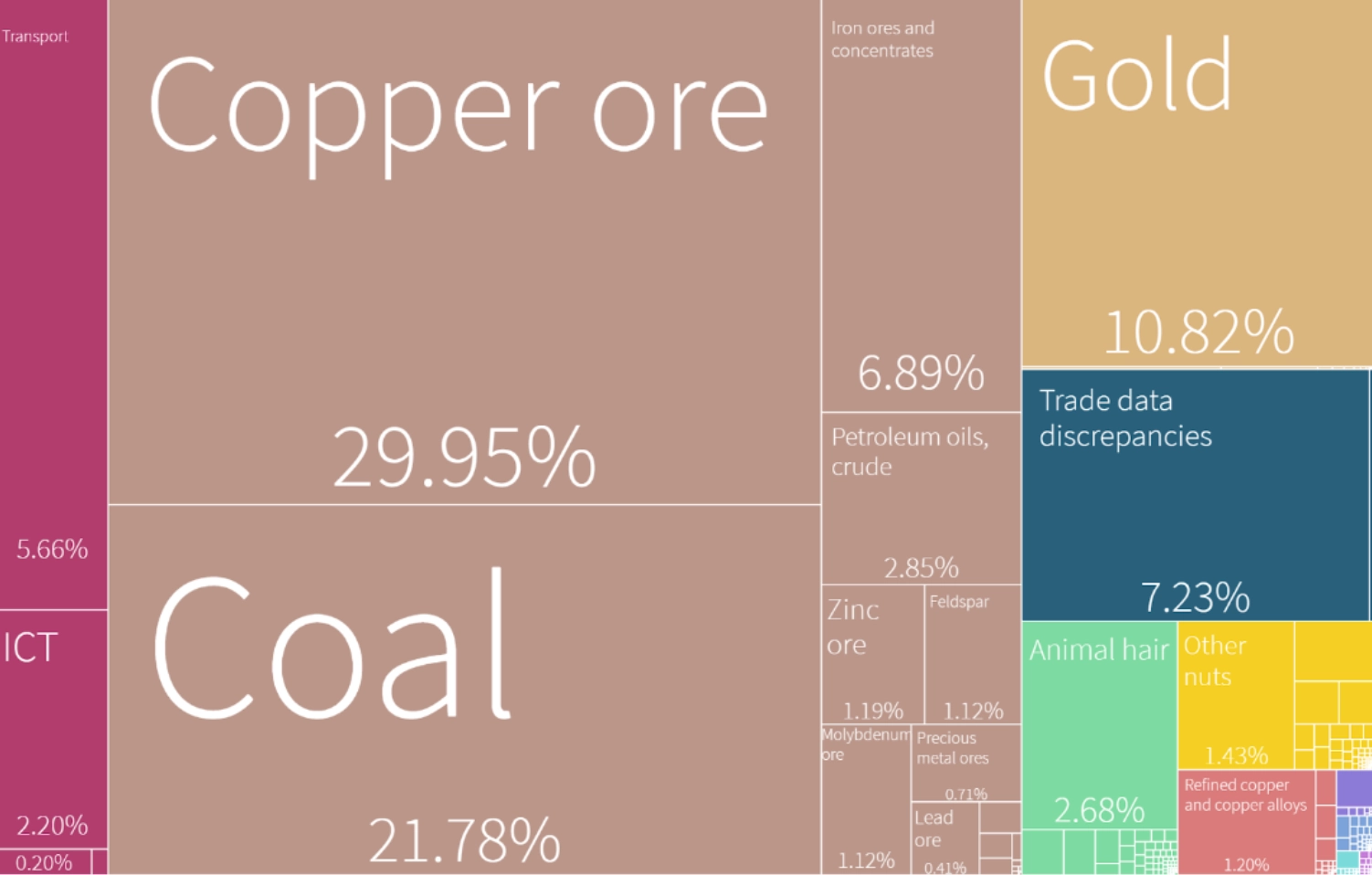

Endowed with abundant natural resources, including prominent reserves of copper, gold, and coal, Mongolia's economy is deeply rooted in the mining sector. The nation stands among the leading countries in terms of the quantity and value of its mineral deposits, making mining a foundational industry since the late 1990s.

In 2020, this sector was responsible for over three-quarters of Mongolia's exports and accounted for 21.6% of its GDP, demonstrating the government's reliance on mining for revenue—approximately 31% from this sector alone, largely derived from royalties and corporate taxes related to mining activities.

Mongolia's export structure(2021)(Data Source:The Atlas of Economic Complexity-Mongolia)

Mongolia's landlocked position presents significant challenges to expanding its trade, particularly in energy. The absence of access to sea routes precludes the nation from cost-effective maritime shipping, often the most economical choice for transporting bulk commodities over long distances. This limitation narrows Mongolia's market reach and raises the cost of transactions, as exports must transit through Chinese or Russian territories, accruing higher transport and logistics costs that can dampen economic competitiveness.

As a consequence, Mongolia has become heavily dependent on trade with its immediate neighbors, particularly China, which not only has a large market capable of absorbing Mongolia's increasing output but also offers lower transportation costs. In 2022, China was the destination for more than three-quarters of Mongolia's exports, highlighting this economic interdependence.

China is Mongolia's largest export partner with 7633 US$ Mil, which takes 82.6% of the total exports(Data Source: World Integrated Trade Solution)

The expansion of Mongolia's railway infrastructure, specifically the construction of new border railway lines, is anticipated to catalyze economic recovery and enhance the logistical framework of the nation, potentially providing an annual freight capacity of 30-50 million tons.

This development is expected to significantly increase Mongolia's export capacity, improve the efficiency of its primary industry, and generate considerable net profits. Furthermore, it will likely lead to the creation of numerous jobs and bolster bilateral trade with China, thus improving economic ties and living standards within Mongolia.

A Mongolian working at Tavan Tolgoi Coal Mine(Credit: Subel Rai Bhandari,Radio Free Asia)

The Border Railway Projects are projected to substantially decrease the cost of transporting coal, enhancing Mongolia's competitiveness and facilitating the entry of its coal into the Chinese market more cost-effectively, further solidifying the trade relationship between the two nations and fostering economic connectivity.

Navigating the Future: Obstacles and Uncertainties for Mongolia's Rail Infrastructure

While the new Mongolian cross-border railway lines bring substantial economic potential, harmonizing with both the government's vision and the Belt and Road Initiative, they also introduce various challenges, especially for the controversial part of Mongolia’s long-term Vision 2050 Strategy. The railways are constructed to enhance Mongolia’s coal exports to China, promising to reduce transportation costs and bolster the market presence of Mongolian energy.

However, this progress is shadowed by pressing domestic and international concerns. Corruption, particularly in the mining industry, has sparked public outcry and protests such as those of October 2022 when people gathered in Mongolia’s capital Ulaanbaatar to protest the officials who colluded with the mining companies, stealing the coal reserves and taking the money into their own pockets.

Laws and regulations on mining are often used as tools for corruption, and this greatly harms the competitiveness of the new railway lines in boosting economics and bringing social welfare to Mongolian people. Such corruption undermines the trust in the sector that fuels Mongolia's economy, threatening the integrity and potential of the railway infrastructure to contribute to broad-based economic and social benefits.

Mongolia's prime minister met with protesters in the capital Ulaanbaatar, vowing to solve the 'stolen coal' case after days of demonstrations.

Furthermore, the technical discrepancy in railway gauges between Mongolia and China imposes additional costs and logistical hurdles, slowing down the efficiency of cross-border exchanges. In the old China-Mongolia-Russia railway, China used the double track, while Mongolia and Russia used the single track.

In the new cross-border railway lines, most of the new railway lines were still using gauges of different sizes. This infrastructure incompatibility, often attributed to national security considerations, necessitates the swapping of gauges at the border, impeding the seamless transport of goods.

Moreover, Mongolia's commitment to sustainable development, as outlined in its Vision 2050 and its Nationally Determined Contribution to The Paris Agreement, is at odds with the realities of its growing mining operations. The increase in coal extraction, partly facilitated by the railway expansion, raises questions about the ecological impact and the nation's environmental commitments. The visible growth of mining areas, like the Tavan Tolgoi Coal Mine, highlights the tension between economic and environmental objectives.

The expansion of coal extractions can be easily seen in the pictures below: The areas in black are the extraction areas of the Tavan Tolgoi Coal Mine, Mongolia’s largest coking coal mine. From 2013 to 2023, the extraction area expanded nearly two times. The economic incentives for exporting coking coals, as well as the lack of environmental law enforcement, led to such immoderate expansion in extraction, which explained Mongolia’s unrealized environmental pledges.

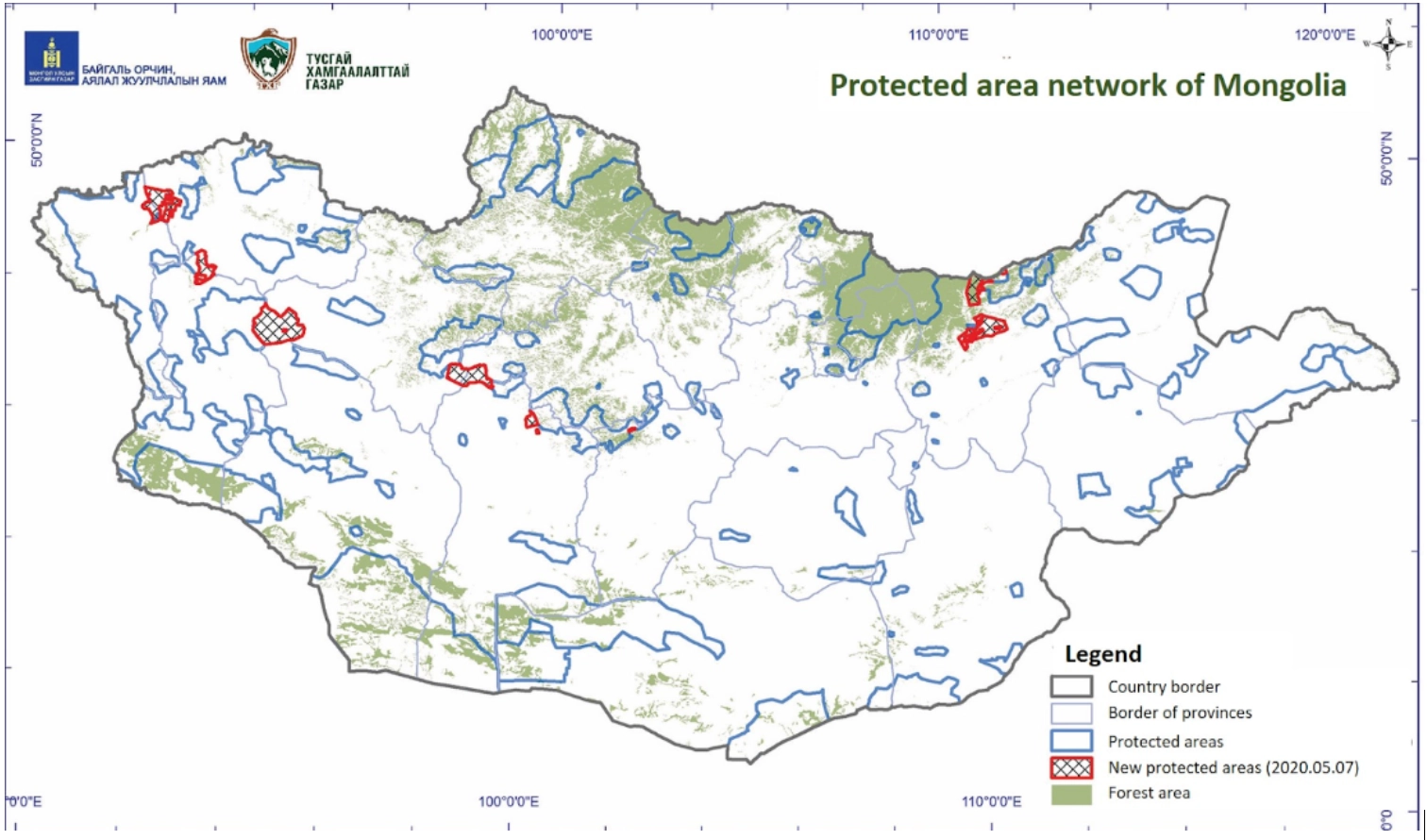

The railways also traverse delicate ecosystems, risking environmental degradation in a country already grappling with desertification. The land along the China-Mongolia railway lines takes up about half of the desertification land in Mongolia. Big Earth Data in Support of the Sustainable Development Goals indicates the vulnerability of the ecosystem in nearby regions.

Moreover, the cross-border railways are expected to cross two protection areas in Mongolia, and the increasing impact of human activities on the environment during construction needs to be considered, to alleviate the pressure on deteriorating land degradation situations. These potential ecological disturbances must be balanced against the railways’ economic promise.

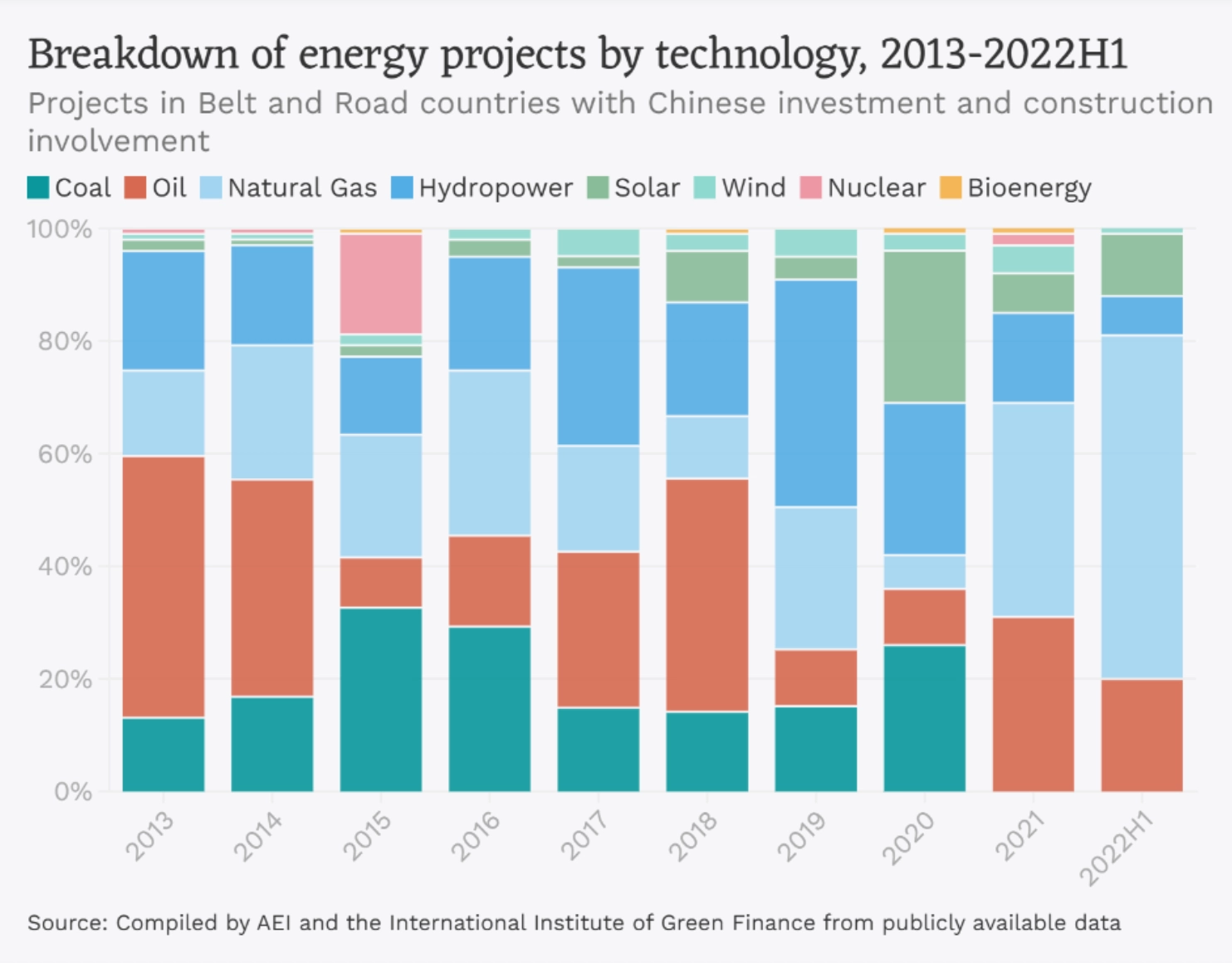

Moreover, China’s pivot towards greener energy initiatives casts further uncertainty on the long-term viability of Mongolia's coal-dependent railway infrastructure. In a video recording presented at the United Nation’s annual conference in 2021, Xi Jinping, China’s leader committed to environmental protection: “China will step up support for other developing countries in developing green and low-carbon energy, and will not build new coal-fired power projects abroad."

China has stopped its coal-projects investments in the BRI (Data Source: China Dialauge)

As China seeks to curtail investments in overseas coal power projects, Mongolia’s rail investments may face challenges aligning with these shifting energy paradigms. The future of the railway lines remains thus unknown, as the singular coal export may not be sustainable after China finishes its energy transition.

Conclusion

In the intersection of potential prosperity and intricate geopolitics lies "Rails of Opportunity: Mongolia's Crossroads Between Energy Boom and Geopolitical Dilemma." Mongolia's wealth of energy resources aligns with China's extensive energy requirements, dovetailing with Mongolia's economic strategy to nurture an export-oriented economy.

This strategy complements China's Belt and Road Initiative (BRI), driving the construction of border railway lines intended to amplify Mongolian energy exports to its giant neighbor. Upgrades to this critical infrastructure are poised to reduce transportation costs, bolstering the viability of Mongolian energy commodities in the global market.

A Mongolian platelayer leading the train "down the path"

Yet, the path forward is strewn with hurdles: domestic and international trepidations cast long shadows over the evident advantages of railway expansion. Concerns range from the environmental impacts of over-mining to the specter of corruption, which threatens to redirect the fruits of economic growth to a select few, bypassing the broader Mongolian populace. Moreover, the long-term implications of Mongolia's reliance on coal exports, in the face of China's evolving energy landscape, introduce an element of uncertainty.

As Mongolia navigates these crossroads, the ultimate outcome—whether these rails will lead to a sustainable boom or a complex geopolitical bind—remains to be seen. The crux lies in managing these complexities to ensure shared economic growth while upholding the principles of sustainability and respect for the environment, safeguarding the legacy of Mongolia's energy trade for future generations.

China's envision of 6 corridors in Belt and Road Initiative(Credit: Standard Chartered)

China-Mongolia-Russia Economic Corridor(Credit:Standard Chartered)

Mongolia-China border locations

Locations of some main stations for China-Mongolia border railways 塔班陶勒盖煤矿: Tavan Tolgoi Coal Mine(Таван Толгой) 噶舒苏海图: Gashuun Sukhait(Гашуун Сухайт) 宗巴彦: Zuunbayan(Dzüünbayan) 杭吉: Khangi(Ханги)

Protected area network of Mongolia

Satellite Image of Tavan Tolgoi Coal Mine (Left: 2013; Right: 2023)

Credit: Deposit Photos